Get instant access and start testing right now

Sign up for a sandbox account in seconds.

Browse the documentation and see how it all works.

Integrate to Radial Payments to ensure a frictionless buying experience and drive sales uplift.

Integrate to Radial Fraud to boost conversion and stop fraud for good.

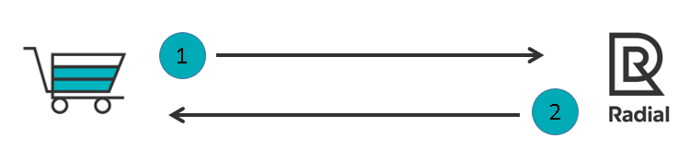

Payment Processing

Here’s how a typical credit card transaction works using our service:

Credit Card Authorization Request

The initial request for card authorization.

Credit Card Authorization Response

Our response to the card auth request, includes a list of response codes.

Payment Settlement Request

At time of shipment send us a request to settle funds with the bank.

Fraud Management

Here's how we protect your business from fraudsters.

order and cover you in case its fradulent.

Javascript Collector

Captures environmental data used for fraud analysis.

Risk Assessment

Initial call to sending us key data so we can properly evaluate the fraud.

Order Confirmation

Letting us know you shipped so we can track the order and provide full liability coverage.

Taxes, Duties & Fees

Here's how to ensure proper taxes are calculated, presented and reported.

Tax Quote

Initial call to Calculate and return the tax quote for every line item.

Tax Invoice

To invoice the tax data for legal and reporting purposes.

Tax Distribute

Account for tax credits and distribute the credits and any adjustments.